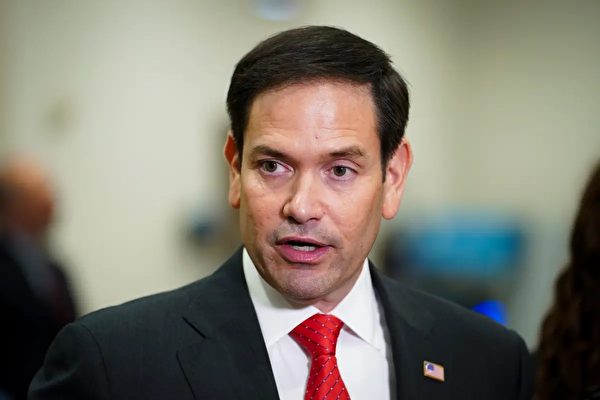

In the latest news report, Marco Rubio, the leading Republican on the Senate Intelligence Committee and a prominent hawk on China issues in Washington, has urged the UK to investigate whether the fast-fashion giant SHEIN has been using forced labor in its operations before it goes public in London.

Rubio expressed his concerns in a letter to the UK Treasury Secretary Jeremy Hunt regarding SHEIN’s upcoming listing in London. He highlighted SHEIN’s close ties to the Chinese Communist Party and reported violations of human rights and exploitation of trade loopholes, which could pose risks to businesses and investors.

The Senator called on the UK to scrutinize the allegations of “unethical and irresponsible business practices” by SHEIN before allowing it to go public in London. Previously, SHEIN had applied for an initial public offering (IPO) on the US stock exchange, but following warnings from Rubio and other lawmakers, the US Securities and Exchange Commission (SEC) increased scrutiny. Consequently, SHEIN changed course and aimed to list on the London Stock Exchange (LSE).

Rubio emphasized that he had previously warned US securities regulators about SHEIN’s alleged use of forced labor and trade loopholes. He reiterated these warnings in his letter to the UK authorities, underscoring the need for caution before allowing SHEIN to go public in London.

The letter was also sent to the Chief Executive of the Financial Conduct Authority (FCA) in the UK. Rubio cautioned that despite SHEIN’s claim to be a “global company” and its efforts to conceal its relationship with the Chinese government, all of SHEIN’s contract manufacturers, employees, and warehouses are based in China. He raised concerns about SHEIN’s willingness to seek approval from Chinese authorities and undergo their scrutiny before attempting to list overseas.

Rubio pointed out that the investigation raised an obvious question: what is the Chinese government trying to hide about SHEIN? He listed several accusations against SHEIN in recent years, including allegations of forced labor, sweatshop factories, and trade deception.

The Senator emphasized, “For SHEIN’s success, there are dirty secrets behind forced labor, sweatshops, and trade tricks.” He expressed confidence that the UK authorities would take these accusations against SHEIN seriously, conduct a thorough investigation, and take appropriate action to protect investors.

SHEIN is currently seeking to list on the London Stock Exchange, and both senior politicians from the UK Labour and Conservative parties, including Hunt, have recently met with the company. In the previous funding round, the online fashion group was valued at $66 billion, but many top UK institutional investors have indicated to the Financial Times that they will refrain from investing due to the controversy surrounding SHEIN’s alleged use of forced labor.

Human rights organizations have claimed the presence of forced labor in SHEIN’s supply chain in Xinjiang, although the company has denied this and asserted a “zero tolerance policy” towards forced labor. An investigation by the Swiss NGO Public Eye in May revealed that despite SHEIN’s commitments to improving working conditions, some supplier employees still work up to 75 hours per week, with an average of 12 hours per day.

“This is a tricky issue,” a UK fund manager told the Financial Times, “I believe anyone with an ESG (Environmental, Social, and Governance) team would not be able to purchase it.” He warned that the London Stock Exchange faces the risk of “secondary brand damage.”

Over the years, SHEIN has also taken advantage of the US de minimis customs clearance program to evade customs enforcement and taxes. The de minimis exemption for packages applies to low-value goods with an average value not exceeding $800, exempting them from tariffs and simplifying the import process. Originally intended to expedite customs clearance for entering the US market, it has been exploited by Chinese e-commerce companies like SHEIN for long-term and comprehensive low-cost marketing in the US domestic market.

Currently, Rubio and other bipartisan lawmakers in the US are pushing the Import Security and Fairness Act to address this trade loophole and prevent such practices.