The Biden administration officially proposed a measure on Tuesday, June 11, to prohibit medical debt from being included in individuals’ credit reports. This move aims to prevent large medical bills from having a negative impact on consumers’ ability to apply for mortgages or other loans. At the same time, the government is urging states and localities to take further action to alleviate the burden of medical debt on millions of Americans.

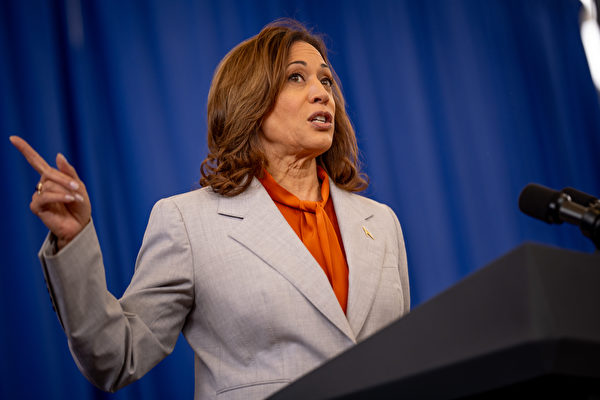

Vice President Kamala Harris and Consumer Financial Protection Bureau (CFPB) Director Rohit Chopra announced this initiative at a press conference on Tuesday.

This action is seen as the latest effort by the Biden administration to help reduce consumer costs ahead of the rematch between Biden, representing the Democratic Party, and Trump before the November election, where economic and inflation issues will be key topics.

The proposal has been in the works for several months. According to a fact sheet released by the White House on Tuesday, if the proposal is approved, medical debt will be eliminated from the credit reports of over 15 million Americans, resulting in an average increase of 20 points in their credit scores and potentially leading to approximately 22,000 more approved mortgage loans per year.

Under the rules proposed by the CFPB, credit reporting agencies will be prohibited from factoring medical debt and collection data into credit score calculations, with up to 46 million Americans having medical debt in 2020.

Previous analysis by the CFPB found that information on medical bills in credit reports is less reliable in predicting future repayments compared to traditional credit debt.

The Vice President also urged state and local governments, as well as healthcare providers, to take additional measures to alleviate the burden of medical debt on millions of Americans, building on the foundation of eliminating $7 billion in medical debt by the end of 2026 under the American Rescue Plan Act of 2021.

Biden and Harris believe that illness or caregiving should not bring economic hardship to American families.

Harris called on states, local governments, and healthcare institutions to take comprehensive action to alleviate medical debt burdens, including but not limited to: using public funds to purchase and eliminate medical debt; expanding coverage of charitable medical care to prevent the accumulation of medical debt, protecting patients from debt collection agencies; and limiting the aggressive debt collection practices of healthcare facilities and third-party debt collectors to protect patients and consumers.

These strategies will help ensure that people do not go into debt to access necessary healthcare.

The Consumer Data Industry Association, representing major credit reporting agencies, stated in a release that they are reviewing the proposal.

Last April, the association announced that Equifax, Experian, and TransUnion jointly removed medical debt accounts with balances below $500 from US consumer credit reports, clearing nearly 70% of medical debt collection accounts.

The proposal will be open for public comments until August 12, 2024. According to Bloomberg, a representative from the Consumer Financial Protection Bureau stated that the new rules could take effect as early as next year.