New York Governor Kathy Hochul, after halting congestion pricing, swiftly proposed implementing a “Payroll Mobility Tax” (PMT) on large corporations as an alternative. This move not only triggered statements of opposition from various businesses and industry organizations but also left lawmakers in a difficult position on the last day of the legislative session of the state assembly on Friday, June 7th.

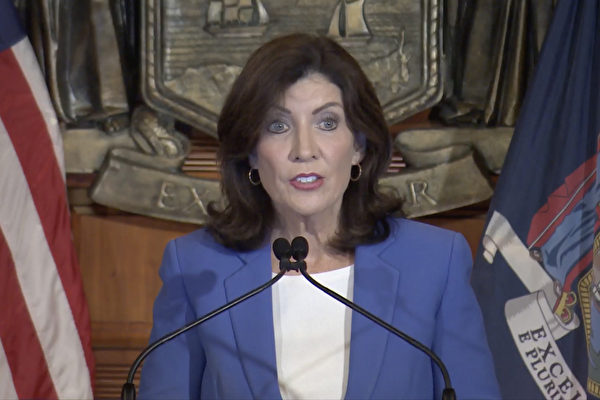

In a press conference, Governor Hochul insisted on considering the livelihoods of New York’s working class, reaffirming her stance on halting congestion pricing. She stated, “My definition of politics is to listen to the voices of the people, understand their current situation, pain, and stress. My job is to listen to the opinions of the people, regardless of the election time.”

Hochul mentioned that she has communicated with the leadership of the Metropolitan Transportation Authority (MTA) and assured that there will be funding to address the short-term operational issues of the MTA. As the revenue from congestion pricing is not expected to be effective until next year, Hochul indicated that her proposal to slightly tax large corporations was merely one of the options that legislators could consider at present.

Addressing the public, Hochul emphasized that the tax target would be the big businesses in New York City, not the employees who have to drive to work, stating, “Some people aren’t as wealthy as everyone imagines and they have to drive into the city. If you work five days a week, that’s an extra $3,600 a year (congestion pricing).”

Since June 7th was the last day of the legislative session of the state assembly, Hochul mentioned that she could discuss the above issues with lawmakers in the next session or return to Albany for further discussions.

State Assemblywoman Grace Lee stated in a declaration on June 7th, “I cannot support the alternative funding plan (congestion pricing) unless it clearly aligns with the best interests of my constituents. I still hope we can work towards improving the congestion pricing plan rather than completely scrapping it.”

According to Politico’s report on June 6th, the Democratic-led State Senate opposed imposing a “Payroll Mobility Tax” on businesses. Long Island State Senator Kevin Thomas, after a closed-door meeting of Democratic legislators, told the media that “doing it now (tax increase) is not wise.”

The business elite organization, ‘Partnership for New York City,’ also released a statement on the same day opposing New York State’s approach of increasing the “Payroll Mobility Tax” to replace the $1 billion annual revenue from congestion pricing, citing that “business taxes and property taxes already make up 44% of the MTA’s revenue.”